This past week we were very fortunate to have Boyan Lepoev come in to chat with us about living on a student budget.

Boyan Lepoev works as Investment Analyst at Bridgeport Asset Management, a boutique investment management firm in Toronto. Previously, he was Market Risk Manager at the Bank of Nova Scotia. Boyan holds the Chartered Financial Analyst designation, a Masters in Finance degree from Queens University and a Bachelor of Commerce from Ryerson University. Most importantly, Boyan learned the hard way the importance of staying on a tight budget while paying his way through school, and is now though these lessons he is now the proud owner of a house in Toronto, as well as, enough savings to continue to travel the globe and explore culinary adventures on weekends with his girlfriend and friends.

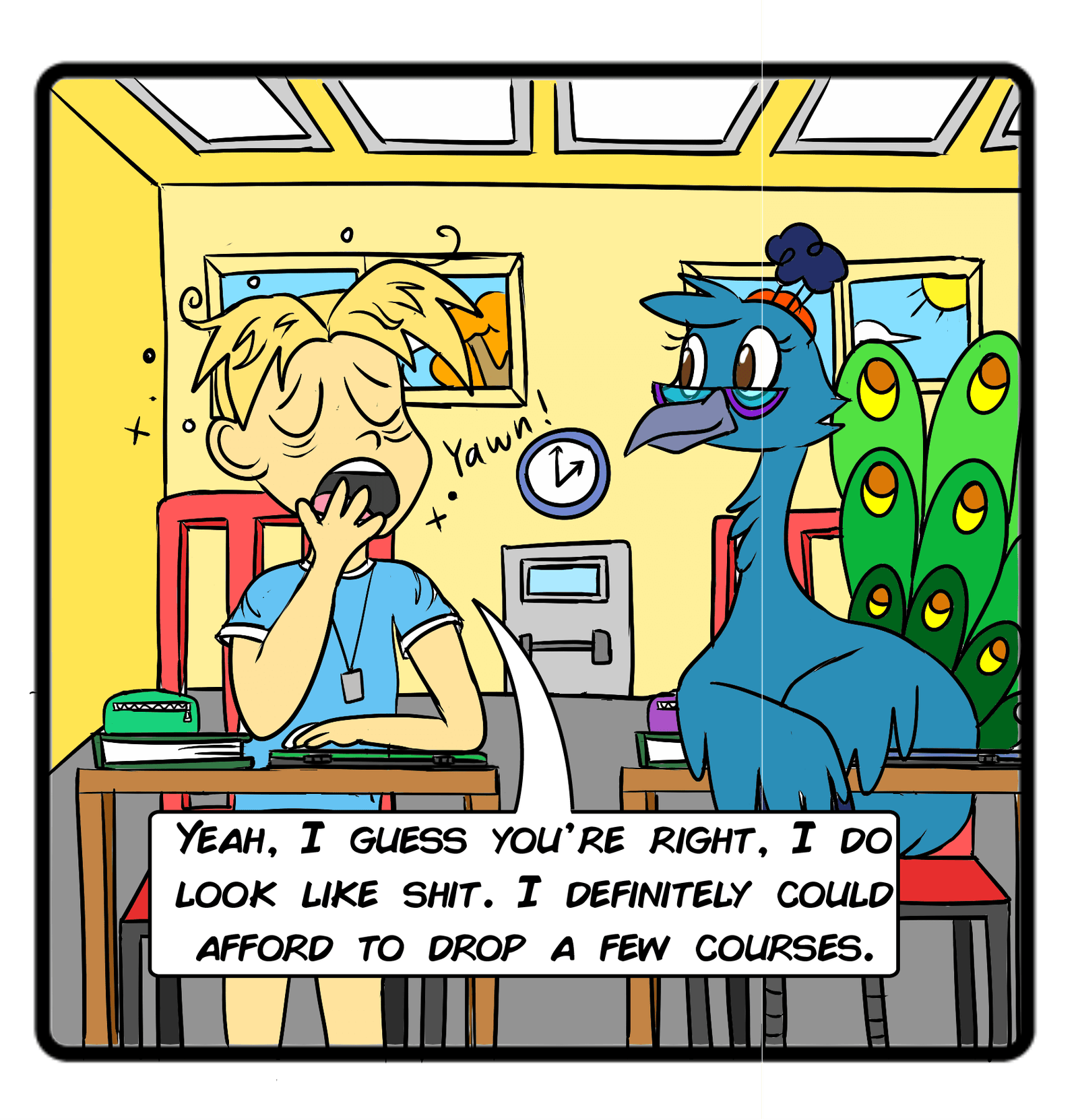

Boyan, after experience as an immigrant and long-time student, believes that the most important thing about living on a budget is to actually create a structure that provides guidelines for daily choices and behaviors that can minimize wasted cash, and maximize savings. Managing your money well will help you to be able to invest in supports and services that can help to enhance your student experience and career development throughout your student experience, rather than rushing to find a job penniless the day after graduation. During his talk, Boyan provided us with 7 areas where you could reduce your daily expenditures as a student.

– Housing:

o Living alone is an excellent way to learn independence, but it is also needlessly expensive, especially in Toronto. A more adventurous alternative is to find a rooming house or enter into a roommate arrangement. Not only it is potentially 30-50% cheaper, but living with others is also likely to positively impact one’s social life.

– Transportation:

o Toronto is a very large city, but has adequate transit system (just ignore the delays). For the cost of a $3 ticket, one can traverse the city for more than 2 hours or $116.75 for a student monthly pass. Add some healthy walking or cycling and most areas in the city and the GTA are open for you to explore. Compare this with a typical $20-30 uber ride or leasing a car ($200+ in lease and another $250 insurance/month)

– Food:

o Toronto has an amazing food scene – foods from across the whole world are available for you to buy, typically stuffed with salt, sugar and a variety of preservatives. Cooking, on the other hand, is more economical and healthy. Whereas a typical budget meal would cost $10, home cooked food averages below $4 per serving. Moreover, knowing your way around the kitchen will make you more independent and it is attractive to the opposite sex.

– Banking:

o Today’s society is rapidly moving away from transacting with cash. Instead, we use mobile payments and plastic cards. While more convenient, cashless payments make it really easy to overspend, so always keep an eye on your statement. A great way to do this is with tracking apps, such as MINT.

o Moreover, the “banking” we do is not free unlike cash – the banks are here to make money from you. Utilize the 21 day “grace free” period for credit cards, but be careful to pay the full balance by the due date or face 25% interest rate. Financing a larger purchase with a line of credit is often cheaper (6-13% interest rate), but interest accrues the moment you use the money. Even bank accounts do not come free – “all-inclusive” accounts cost as much as $30/month while a no-frills account could be free, but charge per transaction. Find what works for you and makes the bank the least amount of money!

– Tuition:

o It is surprising how many people do not know about available stipends and student loans. There is also hidden money on campus or in the community, so if are studying something unique or from a particular regional or ethnic group research possible grants, bursaries, and scholarships. Research OSAP – even with the government changes, they will remain interest free while in school and you can negotiate your payment schedule with them after you graduate.

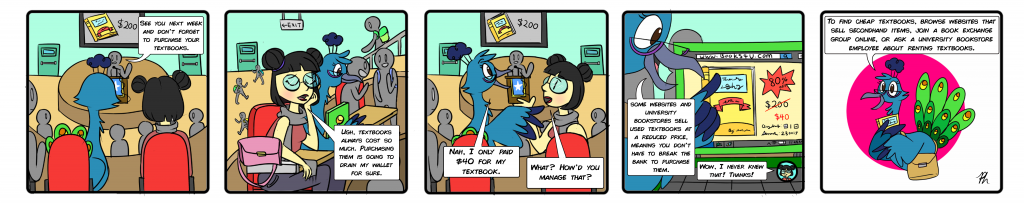

– Books / school supplies

o It is probably safe to assume things have not changed over the last few years and universities still profit immensely from textbook sales. While certain courses necessitate a brand new book for some special software, other courses only require a recent version. Hit the second-hand stores, your school forums or your peers. A second hand book would cost a fraction of the price. A favorite of Boyan’s is www.abebooks.com.

– Everything else – clothes, supplies, entertainment:

o Everyone has different needs, but there are couple rules of thumb I like to follow. Do not buy things you do not need/won’t use more than few times – try and borrow them instead. Utilize second hand virtual marketplaces such as Kijiji and Facebook to find items you need on deep discount (including small electronics which get obsolete quickly).

Boyan’s keystone piece of advice is not to spend to impress someone else; instead, spend on what will make your life easier, happier or more adventurous.